Blockchain Won’t Win Until It Stops Talking to Itself

Crypto UX is broken - and fixing it starts with dropping the ego

Sending crypto is still harder than sending an email. That one sentence explains why blockchain hasn't gone mainstream yet.

The technology is there. The use cases are real. The infrastructure is evolving fast. And yet, only about 6.8% of the world's population owns any crypto. This isn't just about regulation, price volatility, or media skepticism. This is about experience.

Crypto was built by engineers, for engineers. And that's exactly why most people still don't use it.

Your Exclusive Club Sucks

Most crypto platforms feel like tools built by people who don't want you there unless you speak the language. The first thing you often see when opening a wallet? A warning about your seed phrase, a bunch of long hexadecimal strings etc.

There's nothing wrong with being technical. But when the attitude becomes if you don't get it, you don't belong here - that's when we lose the plot.

This isn't just about design patterns. It's cultural. Crypto still wears its complexity like a badge of honour. Users who struggle to onboard are often dismissed with: "DYOR" (do your own research)… a phrase that was meant to encourage critical thinking, but now often acts as a wall to honest questions and feedback.

It's become shorthand for: "Figure it out yourself. If you can't, maybe this isn't for you."

But mass adoption doesn't happen in exclusive clubs. It happens when something becomes useful, safe, and intuitive for the average person.

The Crypto-Rich Kids with No Users in Mind

Let's be blunt. A lot of crypto was built by very smart, very young, and very rich engineers who never worked a regular job, never built products for non-technical users, and never needed to think about trust, friction, or real-world onboarding.

Many of them got rich quick in their bedrooms. Early tokens, early mining, early hype. They didn't have to build for scale or retention. They didn’t have to hustle. They built for themselves and their community. They built for the Discord crowd. And it shows.

This has created an entire generation of builders who don't deeply understand how people think or behave outside of crypto. The arrogance of the early crypto crowd - a mix of technical brilliance and cultural immaturity, resulted in a product landscape that feels foreign, unwelcoming, and disconnected from everyday use.

There's an implicit belief that if people don't "get it," they're not worthy of it. That attitude has stunted the entire industry's growth. You can't create a revolution if your product only speaks to the already-converted.

It's not just that the UX is bad, it's that it was never even a priority. It's seen as secondary to the protocol, when in reality it's the front door.

That's why so many crypto products are still just wrappers around protocols. No onboarding, no empathy, no support. And when something breaks? It's on you for not reading the whitepaper. Or alternatively the answer is “but we want decentralisation“.

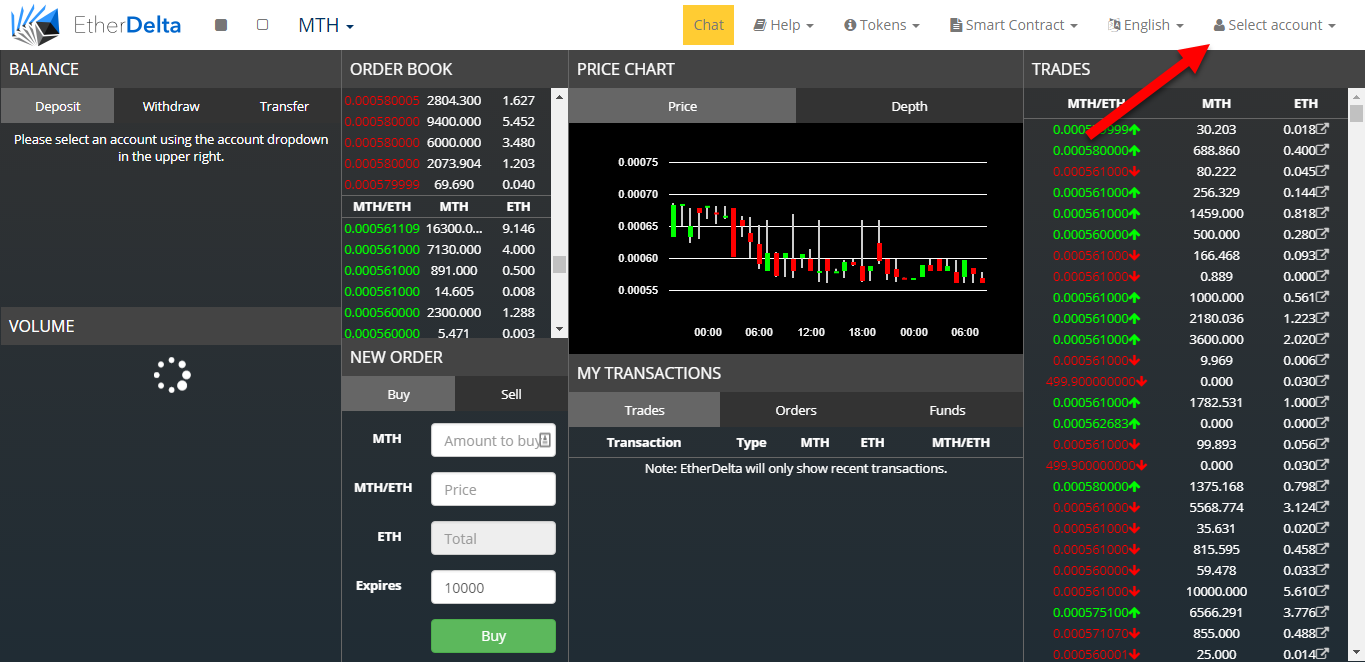

The EtherDelta vs. Uniswap UX Lesson

One of the best examples of design making a difference: EtherDelta vs. Uniswap.

EtherDelta was a functional decentralized exchange. But its UI was a mess — technical, cluttered, and unreadable for most people. It looked like a spreadsheet smashed into a command terminal.

Then came Uniswap. It replaced walls of order books with a clean, simple swap interface. It introduced a playful, weirdly memorable identity (the pink unicorn), and embraced simplicity. And it took off.

But even Uniswap, while cleaner, still speaks to the Web3 crowd. It's all about appealing to the same nerdy crypto bros - the flashy pink colors, the quirky unicorn mascot. Would your 56-year-old (relatively wealthy) uncle feel comfortable trusting this app to transfer the $58K deposit for his new rental house? The next leap isn't just cleaner UIs. It's making these tools feel familiar, trustworthy, and useful to people outside the crypto bubble.

We've Seen This Movie Before

AI existed for decades. Researchers built crazy-powerful models. But mass adoption didn't happen until ChatGPT showed up with a familiar, chat-style interface. And then everyone followed…

It felt like texting a smart friend. No one needed to understand transformers or LLMs. They just asked questions.

That's the unlock: the experience matched what people understand, are familiar with, and comes natural to them.

Crypto needs the same shift. No more whitepapers at step one. No more assuming everyone knows how to "bridge" assets (just say "convert" or "swap") or check "gas fees" (call them "transaction costs"). Fuck "liquidity pools" … just say "trading markets." We need to use language and concepts people already get, dead simple and without the jargon.

In the Global South, Crypto Is Already Real

While the West argues over UX and regulation, people in the Global South are already using crypto for real-world problems.

I recently spoke with a heavy Bitcoin user from South America. He said:

"For me, BTC isn't innovation… it's freedom. It's everything. My country's system is broken. I need to be protected. It’s justice."

In countries like Argentina, Nigeria, and Turkey, crypto isn't about yield farming. It's about escaping inflation, dodging capital controls, and protecting savings.

People are willing to fight through bad UX when the need is strong enough. But in stable markets, that's not the case. Without real necessity, complexity becomes a dealbreaker.

Stablecoins: The Trojan Horse

While BTC and ETH dominate headlines, stablecoins are doing the heavy lifting.

In 2024:

$27.6 trillion was transferred using stablecoins (more than Visa + Mastercard combined)

Over 30 million active wallets (+53% YoY)

$230 billion market cap as of March 2025 (+56% YoY)

Why? Because they feel like money.

People already trust USD, GBP, and EUR despite inflation (they believe that's how it is... we're programmed with them). Stablecoins mimic the experience of fiat but improve on speed, access, and cost. There's no volatility, no learning curve, and no need to explain what a "block" is.

They're also invisible. It means the tech is finally doing its job - running in the background … more or less…

A few reasons behind the rapid rise:

Price stability: Users avoid volatility while staying in the crypto ecosystem

Reduced risk: Stablecoins hedge against failing markets and unstable currencies

Efficiency: Transactions are faster, cheaper, and more straightforward than traditional banking

Business-friendly: Predictable value makes stablecoins more appropriate for payroll, finance, and commerce

This combination of familiarity, speed, and utility is exactly what most people and businesses are looking for.

UX Isn't Just Interfaces - It's Language, Trust, and Support

The design failure in crypto isn't just about layout or buttons. It's about the entire experience and culture.

Products are named things like "zk-rollup bridge aggregator v2"

Wallets break and users have no one to call - you're sent to a Discord server or a 50-page whitepaper. You serious?

There are no trust signals, no audits in plain view, no live help

Recovery flows are terrifying ("lose your keys, lose everything"). And the usual sh**ty excuse? “Well, it’s decentralised at the end of the day.” As if that makes everything okay.

Web2 got this right: clear copy, glossaries, onboarding flows, OAuth login, password resets, live support, user reviews, trust badges.

Crypto needs to steal these patterns shamelessly, and more importantly, it needs to drop the ideological mindset.

We want to leap straight from zero to full decentralization. But that's not how mass adoption will work. We'll need to pass through transitional steps.

Maybe the wallet isn't 100% trustless yet. Maybe the recovery flow involves a third party. Maybe some training wheels are okay.

That's not failure, it's progress. It's the bridge between the hardcore and the curious

Most People Will Trade Sovereignty for Convenience

Decentralization is powerful. But it comes with cognitive and emotional cost.

The reality? Most people don't want to be their own bank. They want to log in, get help, and know someone has their back.

There will always be hardcore users who run nodes and guard their seed phrases. But that won't scale to billions.

Instead, we need to build a UX spectrum:

Custodial, semi-custodial, and self-custody as choices

Progressive disclosure (start simple, unlock advanced)

Products that earn trust and reduce risk

Convenience wins when it's easier, clearer, and safer. And the truth is - for most people it always will.

The Real Battle: Who Owns the Infrastructure?

Adoption is coming. The question is: who owns it?

If Stripe, MoonPay, and fintech giants build the best UX, they'll control the stablecoin rails. Crypto will go mainstream, but it will be corporate.

If decentralized players win, we get an open ecosystem, but only if we stop treating good UX as a betrayal of the mission.

The idealists think compromise means failure. But history tells us the opposite: tech becomes transformational only when it becomes invisible.

We can't have both unless we evolve the design mindset.

The Moment…

Blockchain doesn't need more innovation. It needs better translation.

The tools exist. The infrastructure is getting better. But until people can use crypto without knowing it's crypto, we won't break past the current ceiling.

That means:

Speak human, not protocol

Design flows, not whitepapers

Remove mental friction

Build trust with transparency

Create products that feel inevitable

When it just works, people will use it.

We keep waiting for the iPhone moment. But maybe it's something smaller.

Make the progress more gradual. Add a bit of centralization if needed. Don't be so idealistic. Build the bridge that gets people to the other side first, then worry about perfection.

The winners of this next wave won't just be engineers (though technical excellence matters). They'll be teams that bring together great engineering with storytelling, and human-centered design.

Because that's what turns great tech into real adoption.

Until blockchain is built for everyone, it'll keep talking to itself.